American International Gemologists

Gemological Laboratory: Field Gemologists, & Field Research Gemologists

Sunday, May 11, 2025

Norman Monteau Unveiling the Secrets of Reed Gold Mine

Tuesday, May 6, 2025

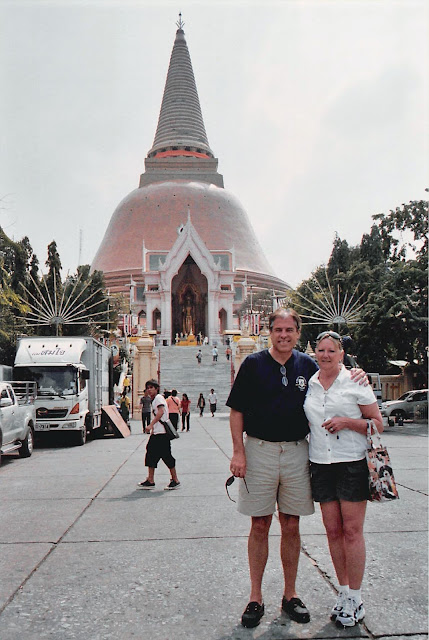

Norman & Sande Monteau in Bangkok after a trip into Cambodia to visit a few of the sapphire mines.

Flashback Friday to September 2006

|

Phra Prathom ChediMueang Nakhon Pathom District, Nakhon Pathom 73000 Thailand

After returning to Bangkok from a field trip to the Pailin Province in Western Cambodia, Sande & Norman Monteau went up to Nakhom Pathom to visit the Phra Prathom Chedi. In the image above we are at the bottom of the North Gate stairs, below the Standing Golden Buddha. You can see the Buddha in the picture.

The stupa is 390 feet high, it is the largest stupa in Thailand, and one of the largest in the world. The chedi was built on the site where Buddhism was introduced into Thailand two thousand years ago.

Nakhom Pathom is located 38 Miles/ 62 KM west of the Chao Phraya river hotels in Bangkok. This can be a day trip from Bangkok. Hire a car and driver for the day to get over there.

Latitude: 13° 49' 6.59" N

Longitude: 100° 03' 22.20" E

|

Friday, April 4, 2025

Trump's Tariff Tsunami: Are Diamonds in Danger?

Sunday, October 7, 2018

AIG Presents the GIA Colored Gemstone Value Factors

PART 1 OF 5 IN THE SERIES: VALUE FACTORS, DESIGN, AND CUT QUALITY OF COLORED GEMSTONES (NON-DIAMOND)

Originally published in GemGuide in 2016, this comprehensive series examines the quality factors that influence the value of colored gemstones, with a specific emphasis on the role cut quality plays in determining the value of faceted gems. GIA researcher and cut expert, Al Gilbertson, examines the elements of cutting, investigates the choices and tradeoffs a cutter makes and why, and provides guidelines for assessing various aspects of cut quality for colored gemstones.

This web version of the original series is divided into five separate articles and reflects minor stylistic edits to the original.

This web version of the original series is divided into five separate articles and reflects minor stylistic edits to the original.

INTRODUCTION

Sande Monteau from aiglabs.com presents this GIA series. It will illustrate how to assess the elements of cutting for colored gemstones and how to better understand the impact of cut quality on the value of various gems. Part of that will include understanding the choices a cutter makes and why. While our focus is on forms of faceted gems, we will briefly touch on non-faceted gems.

For our purposes, the word “cut” means more than just the shape of a gem; it also encompasses the elements of “cut quality.” Cut quality refers to how well the gem was manufactured, or how well various facets were placed. Combined with the proportions, symmetry, and polish, a well-cut gem should have a beauty that not only comes from its color and clarity, but from how the facets interact with light.

The quality of the rough material limits the gemstone’s final appearance. Therefore cutters prefer rough that is transparent and without many inclusions. Some gems are rarely eye-clean, so some inclusions become acceptable in those materials. Since color is the highest priority for colored gems, how a cutter manages the light as it enters and exits a gem becomes an exercise in artistry. Ruby rough with a deeply saturated red color and free from even minor inclusions under 10x magnification will produce gems of noteworthy face-up color and appearance, even if the fashioning is poor. But if the faceting washes out the color or muddies its color by mixing dichroic colors, the cutter has failed miserably.

For our purposes, the word “cut” means more than just the shape of a gem; it also encompasses the elements of “cut quality.” Cut quality refers to how well the gem was manufactured, or how well various facets were placed. Combined with the proportions, symmetry, and polish, a well-cut gem should have a beauty that not only comes from its color and clarity, but from how the facets interact with light.

The quality of the rough material limits the gemstone’s final appearance. Therefore cutters prefer rough that is transparent and without many inclusions. Some gems are rarely eye-clean, so some inclusions become acceptable in those materials. Since color is the highest priority for colored gems, how a cutter manages the light as it enters and exits a gem becomes an exercise in artistry. Ruby rough with a deeply saturated red color and free from even minor inclusions under 10x magnification will produce gems of noteworthy face-up color and appearance, even if the fashioning is poor. But if the faceting washes out the color or muddies its color by mixing dichroic colors, the cutter has failed miserably.

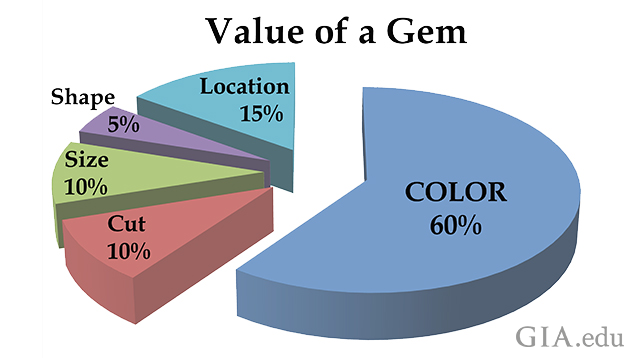

Fig. 1-01. The factors and their relative influence on colored gemstone value, according to Josh Hall, Vice President, Pala International, Inc. Illustration: Al Gilbertson/GIA

Josh Hall (Vice President, Pala International, Inc.) helps place cut within the perspective of a gem’s overall value (from Hall’s personal comments—see Fig. 1-01). He states that color is about 60% of the gem’s value, followed by the location the gem comes from which can influence 15% of the value (this can be much more for certain origins, such as Kashmir sapphire). After that, cut and size each represent around 10% of the value followed by the shape (outline) of the gem. This article will add clarity and color zoning to the discussion. Each of these can be quite variable.

VALUE FACTOR #1: COLOR IS KING!

In color science, there are three dimensions to color: hue (red, green, blue, etc.), saturation(intensity or richness of a color), and tone (lightness or darkness). However, when evaluating the color of colored gemstones, there is another aspect to consider: uniformity of color.

Our eyes see color as seven colors of the rainbow: red, orange, yellow, green, blue, indigo, and violet. Each of these colors is made of rays of light, each traveling at different speeds with different wavelengths. When all of the above colors combine, we see it as white light. When white light enters a colored gem, part of the light can be absorbed. For instance, if a gemstone absorbs all of the colors except blue, only the blue will be visible, and we see the gemstone as blue.

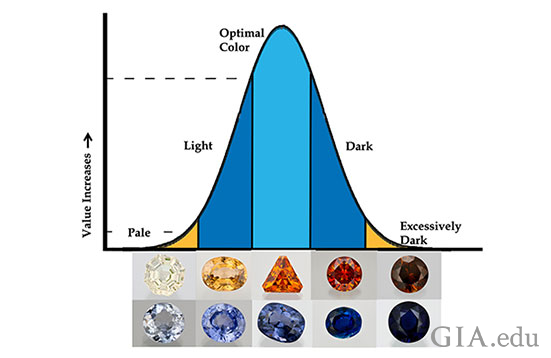

The optimal color range (combination of hue, saturation, and tone) for each gem is different, and for many gems, availability in the optimal color can be scarce (see Fig. 1-02). Pale colors usually have a relatively low value. However, pale blue-green (or mint) tourmaline from Afghanistan/Pakistan commands high prices, much higher than their more saturated counterparts from the same source.

Our eyes see color as seven colors of the rainbow: red, orange, yellow, green, blue, indigo, and violet. Each of these colors is made of rays of light, each traveling at different speeds with different wavelengths. When all of the above colors combine, we see it as white light. When white light enters a colored gem, part of the light can be absorbed. For instance, if a gemstone absorbs all of the colors except blue, only the blue will be visible, and we see the gemstone as blue.

The optimal color range (combination of hue, saturation, and tone) for each gem is different, and for many gems, availability in the optimal color can be scarce (see Fig. 1-02). Pale colors usually have a relatively low value. However, pale blue-green (or mint) tourmaline from Afghanistan/Pakistan commands high prices, much higher than their more saturated counterparts from the same source.

Fig. 1-02. Color correlates with value. The optimal color range varies by gem type and for many gems, the availability for the optimal color can be limited. Row 1: spodumene, sapphire, scheelite, sphalerite, tourmaline. Row 2: sapphire, sapphire, spinel, euclase, spinel. Illustration: Al Gilbertson/GIA. Photos: Robert Weldon/GIA

Wayne Emery (The Gem Cutter) points out that some retailers have learned that there are customers who prefer less saturated stones because they appear to be brighter and have more sparkle. Thus, less saturated gems might sell more quickly than the more saturated (and expensive) ones. From the jeweler's point of view, inventory turnover is very important and can result in much more profit over time. For this reason, some retailers prefer to use gems of lesser saturation in their designs to cater to this customer base.

Gems that are so dark that it is difficult to see through them are more difficult to sell and thus their cost usually drops significantly. The optimal color can cause values to spike significantly. In most cases (except bi-colored gems), color uniformity or evenness is also part of this value equation. Gems that show a single pure hue are usually more valuable than gems that face-up with multiple hues. For example, evenly blue sapphires have more value than those with secondary green hues. For a colored stone (non-diamond), color is the most important factor in determining quality.

Gems that are so dark that it is difficult to see through them are more difficult to sell and thus their cost usually drops significantly. The optimal color can cause values to spike significantly. In most cases (except bi-colored gems), color uniformity or evenness is also part of this value equation. Gems that show a single pure hue are usually more valuable than gems that face-up with multiple hues. For example, evenly blue sapphires have more value than those with secondary green hues. For a colored stone (non-diamond), color is the most important factor in determining quality.

VALUE FACTOR #2: UNIFORMITY OF COLOR

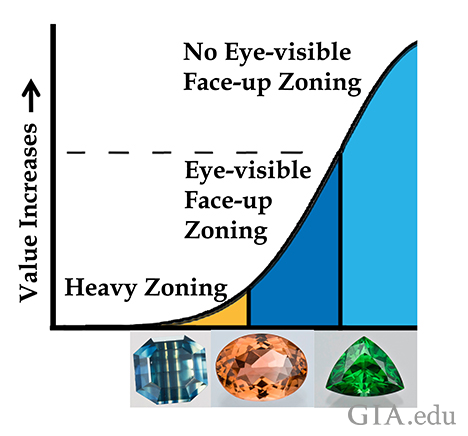

Any uneven distribution of color within a gemstone is called color zoning. Face-up color zoning has a value curve (see Fig. 1-03). Since uniformity of color is a mark of most fine gems, an increase in face-up color zoning is usually regarded negatively. To better observe color zoning, turn the gem upside down on a white piece of paper and look for uneven coloration. You probably won’t see this in some gems, such as peridot or topaz. Now turn it face-up. Can you see the same color zones or splotches of darker or lighter color that you saw when the gem was upside down? Placing the stone in a clear jar with water (or vegetable oil or baby oil—do not use oil with amber), set on a white background can help you see color zoning in a gem.

Fig. 1-03. Color zoning, or the uneven distribution of color within a gem, has a negative impact on value, since uniformity of color is a mark of most fine gems. Sapphire with heavy zoning (left); tourmaline with moderate zoning (center); zircon with no eye-visible, face-up zoning (right). Illustration: Al Gilbertson/GIA. Sapphire photo: Tino Hammid/GIA. Tourmaline, zircon photos: Robert Weldon/GIA

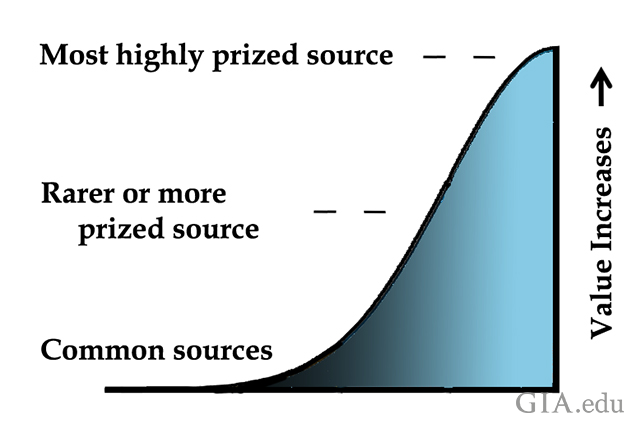

VALUE FACTOR #3: LOCATION OR COUNTRY OF ORIGIN

For many colored gems, the country of origin, or the mining location, greatly affects the value (see Fig. 1-04). For example, this is truer and more extreme for an untreated sapphire of intense blue color from Kashmir, which is worth far more than a similar sapphire mined elsewhere. A few of the major grading labs have the equipment and expertise to determine geographic origin. An origin report from one of these labs is required in validating the gem’s value when highly regarded locations can significantly increase the stone’s price (more than the 15% in a couple of cases).

Fig. 1-04. The potential impact of a gemstone’s country of origin on value. Illustration: Al Gilbertson/GIA

Be cautious and read the report from a lab thoroughly. A standard report usually identifies the gem material, but not the geographic origin. Language used in a standard GIA Identification Report for a copper-bearing tourmaline will state, “This copper and manganese bearing tourmaline may be called ‘paraíba’ tourmaline in the trade. The trade term ‘paraíba’ comes from the Brazilian locality where this gem was first mined, however, today it may come from several localities.” The trade calls these gems Paraíba tourmalines even though the location is not from Brazil. Only if the gem was sent in for a country of origin report, will it indicate the country, such as Brazil. In that case the price will be impacted by the Brazil origin.

The GIA Identification & Origin Report describes whether the stone is natural or synthetic, identifies the type of gemstone along with an opinion on the geographic origin of the stone, and includes any detectable treatments. This report also contains a detailed description of the gemstone such as cut, shape, weight, measurement, and color, and includes a photograph of the gemstone.

Ruby, sapphire, red spinel, emerald, and Paraíba tourmaline all qualify for a GIA Colored Stone Identification & Origin Report. However, that does not mean GIA will be able to determine a country of origin in every instance. GIA determines geographic origin by collecting chemistry and spectroscopic data, and identifying types of inclusions on the sample of unknown origin. That data set is compared to sets of data from reference gems of known origins, looking for compelling evidence that indicates that the unknown is from a certain location. If the data overlaps with gems from two locations or more, and GIA cannot reach a definitive relationship to one location, the report has the result of “inconclusive.”

What's In a Name?

For collectors of crystals, “Herkimer diamond" is a generic name for a double-terminated quartz crystal discovered in and around Herkimer County and the Mohawk River Valley in New York. In the high-end gem market, trade names have been used to denote particular gemstone colors or face-up appearances from specific geographic locations. The names were just as unlikely and profuse: “Paraíba” tourmaline, “Biwa” pearl, “Sandawana” emerald, “Australian” sapphire, “Burma” and “Mogok” ruby. The names persist even when significant locations come and go.

What's In a Name?

For collectors of crystals, “Herkimer diamond" is a generic name for a double-terminated quartz crystal discovered in and around Herkimer County and the Mohawk River Valley in New York. In the high-end gem market, trade names have been used to denote particular gemstone colors or face-up appearances from specific geographic locations. The names were just as unlikely and profuse: “Paraíba” tourmaline, “Biwa” pearl, “Sandawana” emerald, “Australian” sapphire, “Burma” and “Mogok” ruby. The names persist even when significant locations come and go.

A "Herkimer diamond" or rock crystal quartz with negative crystals. Photo: Robert Weldon/GIA

There is still strong consternation amongst many in the trade when a location is used as a name and the gem material isn’t really from that location. That doesn’t stop some dealers from calling a gem a “Kashmir” sapphire when its color mimics material from that location, and charging a false premium. This is why a country of origin report from a major lab becomes important, indicating that the gemstone has been tested and has the features associated with that specific country.

Finally, it should be mentioned that there is a great deal of poor material from highly prized locations, and in those cases knowing the country of origin shouldn’t provide added value.

Finally, it should be mentioned that there is a great deal of poor material from highly prized locations, and in those cases knowing the country of origin shouldn’t provide added value.

VALUE FACTOR #4: COLORED STONE SIZE

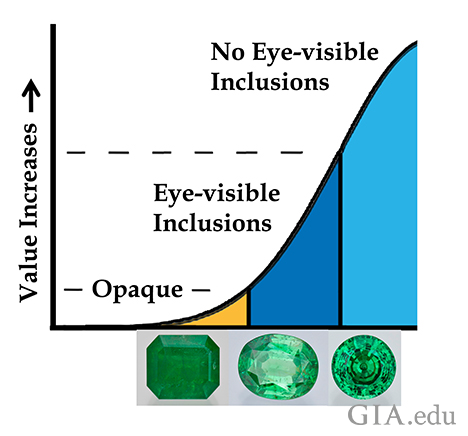

VALUE FACTOR #5: COLORED STONE CLARITY

Clarity is an important value factor because gems are cut to sparkle and show off their color in interesting ways. If there are flaws that interrupt that sparkle, the gem is less interesting. Hence there is a value curve related to clarity that is also true for each type of gem (see Fig. 1-07). Some gem materials are almost always found with inclusions, while others are commonly eye-clean (inclusions cannot be seen without magnification).

There are some inclusions that actually help the value of specific gems. For example, microscopic light-scattering inclusions enhance the color uniformity in Kashmir sapphire by deflecting light into areas it would not normally go. The resulting velvety appearance of Kashmir sapphires adds value. Sunstone is also aided by light amounts of schiller (extremely tiny copper inclusions that create a cloud-like appearance), which in the right locations can add value.

There are some inclusions that actually help the value of specific gems. For example, microscopic light-scattering inclusions enhance the color uniformity in Kashmir sapphire by deflecting light into areas it would not normally go. The resulting velvety appearance of Kashmir sapphires adds value. Sunstone is also aided by light amounts of schiller (extremely tiny copper inclusions that create a cloud-like appearance), which in the right locations can add value.

Fig. 1-07. There is a value curve related to clarity for each type of gem. Kornerupine, demantoid, tsavorite. Illustration: Al Gilbertson/GIA. Photos: Robert Weldon/GIA

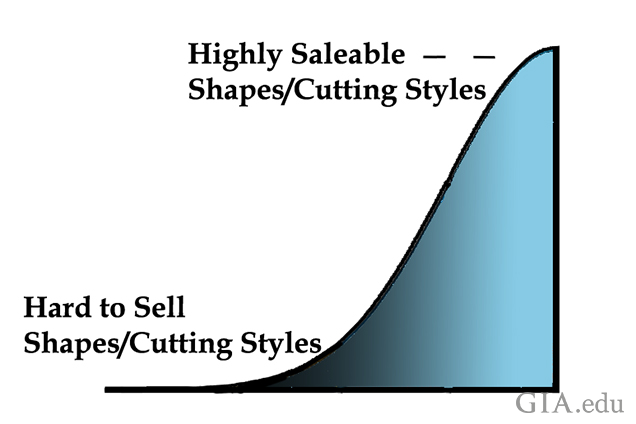

VALUE FACTOR #6: COLORED STONE SHAPES

Demands for shape (a gem’s outline) (see Fig. 1-08) and certain cutting styles have evolved and changed over the years. Certain shapes, often coupled with certain cutting styles, are more popular now because they work better with current jewelry designs. Other shapes are hard to sell as few people desire them, or they only work in a few designs. For instance, pear shapes are rarely sold for anything other than pendants and earrings, limiting their market. The creativity of the designer can help sell certain shapes by creating a unique appeal for a shape that is commonly avoided.

Fig. 1-08. Fashion trends are the primary drivers for gemstone shape and cutting styles. Illustration: Al Gilbertson/GIA

Some gem materials, such as tourmaline, are rarely cut as round shapes. Tsavorite garnet is not often fashioned as an emerald cut. Yet these shapes in these materials sell for more when available. Other materials are almost exclusively seen as round (Montana sapphire) or emerald cut (emeralds). The curve that reflects the current popularity of certain shapes and cutting styles, and their position on the curve, will change over time as demand shifts with fashion trends. Richard Hughes (of Lotus Gemology) pointed out that classics will sell better because fine jewelry is often purchased by older people (young people have less money) who often have conservative tastes.

VALUE FACTOR #7: COLORED STONE CUTTING QUALITY

Let’s stop for a minute and state the obvious: Jewelry and gems are personal, and are a reflection of the person who wears them. Therefore, why would we want to have choices that are not great looking?

Why do jewelers sell poorly cut “gems,” those that only sparkle around the outside with a dull area in the middle? Gemstone artist John Dyer puts it this way: “Poor cutting belongs to a bygone era when customers were not educated or picky enough to care about the quality of their gem. A simple ‘colored stone’ becomes a real GEM with good cutting.” Too many jewelers think poorly cut gemstones are “good enough.”

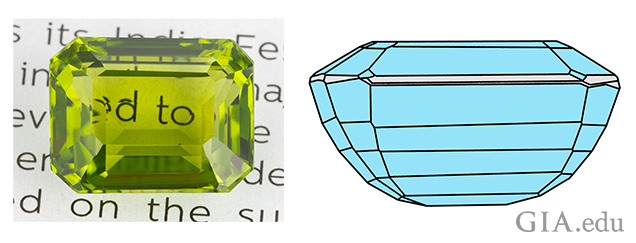

When center (or main) pavilion facets are cut too shallow for that gem material, light passes through so that we see what is behind the gem (see Fig. 1-09). This is called windowing. If we can see the girdle reflecting under the table, it is called a fisheye. As dirt accumulates around the edge of the mounting, that girdle reflection will be the color of the built-up dirt (often grey or brown). These cutting styles are rarely attractive.

Why do jewelers sell poorly cut “gems,” those that only sparkle around the outside with a dull area in the middle? Gemstone artist John Dyer puts it this way: “Poor cutting belongs to a bygone era when customers were not educated or picky enough to care about the quality of their gem. A simple ‘colored stone’ becomes a real GEM with good cutting.” Too many jewelers think poorly cut gemstones are “good enough.”

When center (or main) pavilion facets are cut too shallow for that gem material, light passes through so that we see what is behind the gem (see Fig. 1-09). This is called windowing. If we can see the girdle reflecting under the table, it is called a fisheye. As dirt accumulates around the edge of the mounting, that girdle reflection will be the color of the built-up dirt (often grey or brown). These cutting styles are rarely attractive.

Fig. 1-09. A peridot showing windowing, the result of the shallow pavilion facets. The wireframe depicts the peridot’s facet arrangement to illustrate certain aspects of gem cutting. Illustration: Al Gilbertson/GIA. Photo: Orasa Weldon/GIA

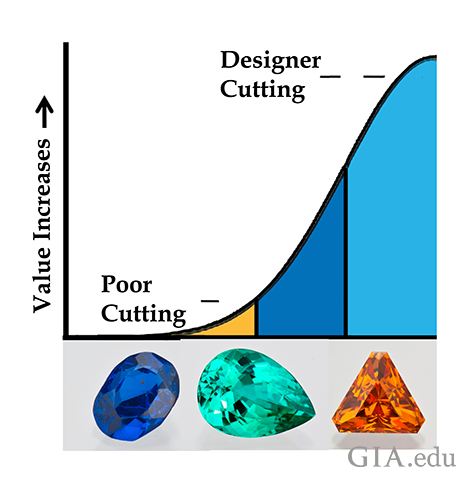

Josh Hall’s last element of colored stone value (see Fig. 1-01) is Quality of Cutting. An exceptionally well-cut gem can add more than Hall’s estimated 10% to a gem’s value. In today’s market, a number of gem cutters are known as “artists.” Gems from named artists can have significant additional value due to the artist’s popularity (see Fig. 1-10). Even local cutters who are not recognized on a national level can get up to 40% added value for their work with some jewelers.

Fig. 1-10. The cut quality of a gem, like other quality factors, also impacts value. Examples of a poor, average, and well-cut gem: spinel (left), elbaite (center), and scheelite (right). Illustration: Al Gilbertson/GIA. Photos: Robert Weldon/GIA

If the gem were uncut, its value would be significantly less. The impact of cutting on a gem’s value is proportionate to its rarity. An extremely rare piece of rough sapphire that sells for tens of thousands of dollars does not necessarily double in price when cut. It has added value, due to the cutting, but the cutting adds only a small percentage. Compare that to the value added to a piece of ametrine rough that may have cost a few hundred dollars but is then cut by a named artist.

In this first installment of the series, we have reviewed the seven major factors that affect the price of a colored gemstone: color, uniformity of color, country of origin, size, clarity, shape, and quality of cutting. Taken together these are the primary factors that determine the overall price or value of various gems in the market in which they are sold.

UP NEXT: Part 2: “Gem Cutting Styles - Definitions” establishes a common language for discussing cutting styles, with a focus on basic faceting styles, and offers a short discussion on cabochons and beads.

In this first installment of the series, we have reviewed the seven major factors that affect the price of a colored gemstone: color, uniformity of color, country of origin, size, clarity, shape, and quality of cutting. Taken together these are the primary factors that determine the overall price or value of various gems in the market in which they are sold.

UP NEXT: Part 2: “Gem Cutting Styles - Definitions” establishes a common language for discussing cutting styles, with a focus on basic faceting styles, and offers a short discussion on cabochons and beads.

ABOUT THE AUTHOR

Al Gilbertson is the Project Manager, Cut Research at the Gemological Institute of America Laboratory Carlsbad. Prior to joining GIA, Gilbertson served on the the American Gem Society (AGS) Cut Task Force, where he made significant contributions, including developing a patent which was acquired by AGS as the foundation of their ASET technology for cut grading. Hired by GIA in 2000, he became part of the research team that created the GIA cut grading system for round brilliant diamonds. Gilbertson is also the author of American Cut—The First 100 Years.

ACKNOWLEDGMENTS

Thanks to Wayne Emery (The Gemcutter), Brooke Goedert (Sr. Research Data Specialist, GIA Carlsbad), Josh Hall (Vice President of Pala International, Inc.), Dalan Hargrave (Gemstarz), Richard Hughes (Lotus Gemology), Stephen Kotlowski (Uniquely K Custom Gems), Andy Lucas (Manager, Field Gemology-Education, Content Strategy-Gemology, GIA Carlsbad), and Nathan Renfro (Analytical Manager, Identification, GIA Carlsbad) for reviewing this article and providing valuable input.

Parts one and two of this series appeared in GemGuide, January/February 2016, Vol. 35, Issue 1; parts three and four in March/April 2016, Vol. 35, Issue 2; part five in May/June 2016, Vol. 35, Issue 3. Note that the article does not use the term faceted in the title. However, the major thrust of this series is faceted gems.

Gemworld International, Inc., 2640 Patriot Blvd, Suite 240, Glenview, IL 60026-8075, www.gemguide.com

© 2016 Gemworld International, Inc. All rights reserved. Permission granted for GIA to publish this at GIA.edu.

Parts one and two of this series appeared in GemGuide, January/February 2016, Vol. 35, Issue 1; parts three and four in March/April 2016, Vol. 35, Issue 2; part five in May/June 2016, Vol. 35, Issue 3. Note that the article does not use the term faceted in the title. However, the major thrust of this series is faceted gems.

Gemworld International, Inc., 2640 Patriot Blvd, Suite 240, Glenview, IL 60026-8075, www.gemguide.com

© 2016 Gemworld International, Inc. All rights reserved. Permission granted for GIA to publish this at GIA.edu.

Saturday, August 12, 2017

Buying a Silver Ring? Order it in Your Ring Size.

It is not an easy thing to do to have a Silver Ring sized according to Norman Monteau the President and Chief Laboratory Research Officer, for Los Angeles Jewelry Appraiser aiglabs.com. Silver Rings today are predominantly manufactured in China so says Sande Monteaux also of aiglabs.com They are made up of a layer of Silver, a layer of Nickel and a layer of Rhodium. The procedure to size a Silver Ring is listed below. After you read the procedure I'm sure that you will understand that you should always buy Silver Rings in the size that you need. Not every jeweler can size a Silver Ring. And I gotta say that most jewelers don't want to do it at all.

This article can be found in benchmagazine.com

Sizing large silver rings with heat sensitive stones is difficult to do with a torch. You need to protect the stone from the heat of the torch, and keep the heat from dissipating through the silver away from the solder seam. An easy method to do this is to place a metal water cup filled with water on your solder pad. Then, support the jewelry with the stones submerged in the water with the place to solder as far out of the water as possible. To make a water cup, cut the bottom 1” off a soft drink can. This works particularly well, as the aluminum does not rust as other metal containers will. Fill the water cup ¾ full of fine white sand and cover with water. Then, the jewelry you are soldering can easily be held in place by sticking the stone into the sand. The cool water will protect the stone and the sand will hold the ring in position for you to solder. Next, you need to deal with heat dissipation. The water will draw heat off the ring, as if silver was not bad enough on its own. To help the situation, place a small piece of firebrick or cutoff from a ceramic soldering pad through the finger hole of the ring. A piece 12mm X 5mm X 30 mm works well. The fire brick blocks the flame from the water helping to keep it cooler and it helps protect the stone. But more importantly it reflects the heat of the flame back up to the ring shank helping the solder to flow. Makes sizing large silver rings MUCH easier.

Monday, July 24, 2017

Multi-Elemental Diffused and Melt-Grown Synthetic Sapphire Identified!

Below is

an interesting report on a multi-elemental diffused and melt-grown Synthetic

Sapphire..... Say What??? This stone

was identified using some very non-standard Gemological equipment including the

Laser ablation–inductively coupled plasma–mass spectrometry (LA-ICP-MS) analysis

and the Short-wave radiation in a https://www.iidgr.com/innovation/diamondview/

DiamondView device. Do Not Panic. Visual inspection in a Stereo Zoom Binocular Microscope

would have caught the gas bubble, and the Beryllium treatment effect on the

pavilion. Norman Monteau Lab Director for AIG Laboratories said "There is still immense identification power in 10x visual inspection,

don't forget that."

GIA’s

Carlsbad laboratory examined a 4.21 ct faceted blue oval. Standard gemological

testing determined that the stone was uniaxial negative and had a refractive

index of nε = 1.759 and nω = 1.769, with a corresponding birefringence of

0.010. Hydrostatic specific gravity was measured as 4.00. The stone was inert

to long-wave UV and showed medium chalky blue color to short-wave UV. These

properties were consistent with heated sapphire, either natural or synthetic.

Under magnification and diffused transmitted lighting, a blue color

concentration was observed along the facet junctions on both the pavilion and

crown facets, along with a few large blue halos on the table facet (figure 1,

top left), which indicated that the stone had been titanium diffused (R.E. Kane

et al., “The

identification of blue diffusion-treated sapphire,” Summer 1990

G&G, pp. 115–133; Summer 2015 GNI, pp. 203–205). Under dark-field lighting,

individual large spherical gas bubbles were present (figure 1, top right).

Numerous clouds observed throughout much of the stone could have easily been

mistaken for natural clouds. Some of them grouped to form natural-looking

fingerprint-like inclusions (figure 1, bottom left). The stone’s internal

characteristics indicated a melt-grown synthetic origin. However, when

immersing in methylene iodide under crossed polarizers and viewing down the

optic axis, no Plato lines were observed (see W. Plato, “Oriented lines in

synthetic corundum,” Fall 1952 G&G, pp. 223–224). The absence of Plato

lines does not rule out flame-fusion growth. The heat from diffusion treatment

can reduce the visibility of Plato lines (S. Elen and E. Fritsch, “The separation of natural

from synthetic colorless sapphire,” Spring 1999 G&G, pp. 30–41).

More advanced testing is needed to reveal all the physical and chemical

properties of this unique stone.

Under

the short-wave radiation (a 20-nm-wide band centered at 225 nm) in a DiamondView

device, the stone displayed a strong chalky blue fluorescence. Hughes and

Emmett (2005) concluded that the chalky blue fluorescence was due to isolated

Ti4+ ions, or Ti-Al vacancy pairs. The strength of the chalky fluorescence

depends on the growth temperature and Ti4+ concentration relative to other

impurities. In melt-grown corundum, the high growth temperature allows Ti4+ to

pair with Al vacancies more easily than other charge compensating ions; this

creates the chalky fluorescence. In contrast, Pairing of Ti4+ with other ions

(usually Fe2+ or Mg2+) and the presence of Fe3+ ions prevent fluorescence. That

could explain why the chalky fluorescence was not present where the blue

diffusion color was concentrated (R. Hughes and J. Emmett, “Heat seeker: UV

fluorescence as a gemological tool,” 2005,

www.ruby-sapphire.com/heat_seeker_uv_fluorescence.htm).

Laser

ablation–inductively coupled plasma–mass spectrometry (LA-ICP-MS) analysis was

performed on the girdle of the stone. Three laser ablation spots were drilled

six times down into the stone. The concentration vs. depth profile is shown in

figure 2. From the surface of the stone to around 180 µm depth, the Be

concentration decreased from 76.8 to 13.9 ppma, Mg from 7.8 to 0.8 ppma, Ti

from 580 to 391 ppma, Fe from 390 to 83.4 ppma, and Ga from 6.12 to 1.36 ppma.

The results confirmed diffusion treatment, not only by Ti and Fe but also by

Be, Mg, and Ga. The presence of Mo provided some indication of synthetic

origin. In a GIA identification report, the stone was described as titanium and

beryllium diffused. It is the first time GIA has examined a multi-elemental

diffused and melt-grown synthetic sapphire.

Saturday, March 4, 2017

Estate Jewelry Appraisals by American International Gemologists, aiglabs.com

Watch This Video, and then say to yourself

"Do I have Family Heirloom Jewelry in the house?"

Make an appointment to have us do an appraisal. We have over 27 years experience appraising Estate Jewelry, and we are the only Estate Jewelry Appraiser between Woodland Hills and Ventura, including Calabasas. We are AIG the Jewelry Appraisers

Friday, March 3, 2017

Late 16th-Century Diamond Marriage Jewel Handed Down from Grandfather

Watch This Video, and then say to yourself

"Do I have any of my Grandparents Jewelry in the house?"

Very Possibly, This Is The Last of The

"New Diamond Finds" in The World.

GAHCHO

KUÉ is too far north for trees. In the few snowless months, its surroundings in

Canada’s Northwest Territories resemble a sprawling archipelago, as much lake

as land, dark ponds stretching flat to the horizon. Wolverines roam, as well as

bears, foxes, hares and caribou, though the herds have dwindled. There are no

roads, no pipes, no electricity cables. So it seems strange when, flying over

the tundra, a giant truck appears, then another, then a steel factory, rows of

trailers and a big grey pit, deepening by the day.

De

Beers, the world’s biggest diamond company, marked the opening of its Gahcho

Kué mine in September. Local indigenous leaders prayed for the mine, beating

drums. Bruce Cleaver, the firm’s chief executive, and Mark Cutifani, the boss of

its parent company, Anglo American, stood by a ceremonial fire, flames tilting

in the wind.

Now the

hard work is under way. The area is so sodden that staff bring in heavy supplies just once a year, in

the depths of winter, when they can build a thick road of ice (pictured above).

If you want to know more about the Ice Roads and the Truckers that run the haul roads watch The Ice Road Truckers on the History Channel were driver’s battle ferocious storms, freezing temperatures, plus warming too, when unexpected warm temperatures

can create a very short winter road season for the Ice Roads. The Real Ice Road Truckers will give you the picture of how tough it is to run the Ice Roads” says Norman Monteau the Lab Director with AIG The Jewelry Appraisers in Los Angeles California. Norman has been on the Ice Roads in Alaska, and he tells our reporters

that “the Alaskan Ice Roads are child’s play compared to the Ice Roads in the

Northwest Territories.

A

caravan bearing fuel and equipment is slowly crossing the tundra. At the mine,

their colleagues are working day and night to ramp up to full production, with

the aim of extracting more than 12,000 carats (2.4kg) of diamonds each day.

Gahcho Kué is an astonishing endeavour, the biggest new mine in the world in

over a decade. De Beers has no plans for another.

It is a

turning-point for one of the world’s oddest industries. The diamond business

gained its sparkle around 1866, when a farmer’s son picked up a glistening

pebble on the bank of the Orange river in South Africa. For most of the next

150 years, De Beers would dominate the global market. Success depended on

manipulated supply and skillfully cultivated demand.

Much has

changed since then. De Beers can no longer control the market. Though it is the

biggest producer by value, it accounts for only a third of global sales, down

from 45% in 2007. It faces many uncertainties, from synthetic diamonds to

changing relationships with polishers and cutters. Its loosening grip is

reflected in increased volatility: its sales fell 34% in 2015, before bouncing

back by 30% last year. Meanwhile the source of the demand that drives sales—the

link between diamonds and love—looks weaker than it used to.

But one

forecast seems solid: there will be fewer new diamonds. De Beers continues to

seek new places to mine, but has slashed its exploration budget. Another big

find is unlikely. The supply of new diamonds is expected to peak in the next

few years, before beginning a slow decline.

Natural

diamonds—as opposed to the synthetic ones mostly used in industry—were formed

more than 1bn years ago deep below cratons, the oldest part of continents.

There, between Earth’s core and its crust, the pressure was high enough and the

temperature low enough for carbon to crystallize into its hardest form. There

diamonds would have remained were it not for molten rock rushing through the

mantle and drawing diamonds, garnets and other minerals with it, like a furious

river pulling dirt from its banks, before erupting through Earth’s surface

faster than the speed of sound.

Some of

the gems settled in river beds, as in Brazil, or were swept to the coast, as in

Namibia. Others remained encased in extinct volcanoes, or pipes, and ended up

buried under soil or lakes. De Beers’s richest diamond mine was found beneath

sand in Botswana in 1972, within the Kaapvaal craton that spans southern

Africa.

Speculation

that diamonds might be found in Canada dates from the 19th century, when gems

were found studded through the American Midwest. In 1888, the year Cecil Rhodes

founded De Beers in South Africa, a 22-carat stone was unearthed near

Milwaukee. Glaciers, it was posited in 1899, might have carried the diamonds

south. It was decades before exploration took off. De Beers began quietly

scouring Canada in the 1960s, but it was not until 1991 that BHP, one of its

rivals, found kimberlite, an igneous rock, with enough diamonds to merit a

mine.

Within

three years more than 100 companies had fanned out across the wilderness,

rushing to claim some 200,000 square kilometers. At Gahcho Kué, geologists used

aerial surveys and soil sampling to follow trails of minerals back to their

kimberlite pipes.

The

objects of these frenzied searches have intrinsic value for scientists. Gems

deemed flawed by jewelers interest them most: inclusions in diamonds can carry

samples from hundreds of kilometers below the surface. Evan Smith, a scientist

at the Gemological Institute of America, recently studied inclusions in shards

cut from diamonds of unusual size and quality. His findings, reported in Science,

a journal, are the first proof that the deep mantle is peppered with metallic

iron—a clue to the long-ago chemical reactions that shaped Earth.

But

diamonds’ principal value has nothing to do with science. They have long been

revered for their beauty—in September Mr Cutifani reminded Gahcho Kué’s

visitors that the ancient Greeks regarded diamonds as the tears of the gods.

Their modern status, though, is a corporate creation, a story inextricably

linked with that of De Beers itself.

Diamonds

had been rare before 1866; the South African finds threatened to send prices

plunging. Rhodes founded De Beers to consolidate the area’s mines and to

restrict sales. By his death in 1902, the firm accounted for 90% of the world

market. More discoveries were made in the 20th century, notably in Siberia in

the 1950s, Botswana in the 1960s and Australia in the 1970s. But De Beers kept

tight control of supply, both by owning mines and by buying diamonds from

others.

That

alone would not have turned De Beers into an empire. As essential was its

scheme for conjuring up demand. In 1938 the company, then led by the

Oppenheimer family, hired N.W. Ayer, an advertising agency in New York, to coax

Americans to buy more rocks. It dreamed up the notion that a diamond ring

should be an essential display of love and status, its gift a rite of passage.

In the ensuing decades De Beers and its marketers penned slogans—memorably, “a

diamond is forever”—and invented social rules, urging men to spend two months’

pay on a gift for their affianced. That benchmark not only permitted high

margins, but suppressed the second-hand market—to the benefit of both the firm

and its customers, who could be reassured their investment would hold its

value.

The

marketing worked. In 1939, 10% of American brides received a diamond engagement

ring. By the end of the century 80% did. The result was a unique industry,

controlled by a single company that was both marketer and miner, a

capital-intensive business built on an ephemeral link to love, its success due

to strangled supply and inflated demand.

But by

the 1990s De Beers’s grip had started to loosen. The Argyle mine in Australia

left the De Beers cartel in 1996, fed up with the giant’s terms. New

discoveries in Canada, a civil war in Angola and the collapse of the Soviet

Union all made supply harder to manage, meaning that more diamonds were sold

outside the cartel. Concern that diamond sales were financing African conflicts

threatened the gem’s image.

In 2000

De Beers said it would no longer control the market so strictly, but sell

instead to vetted buyers. Legal settlements in America and Europe followed,

barring the company from monopolistic behavior.

De Beers

is adjusting to the new era. Its first challenge is an unfamiliar one: to

grapple with competitors. ALROSA, Russia’s state-owned diamond company,

produces more stones than De Beers, though it earns less (see chart). New firms

have cropped up, too, some buying mines from De Beers as it sought to shore up

its balance-sheet.

De

Beers’s partners, meanwhile, have become more demanding. Botswana’s government

owns 15% of the firm; South Africa’s state investment fund owns 14.5% of Anglo

American. De Beers’s mining operations in Botswana and Namibia are joint

ventures with the governments there. Both countries share the proceeds from

sales of diamonds mined within their borders, and can also sell some diamonds

independently, enabling them to test the prices that De Beers is getting and

further loosening the firm’s control over supply.

Even in

countries where De Beers does not have a joint venture with the government, it

depends on local co-operation. Winning government approval for Gahcho Kué

required more than 15,000 pages of environmental reviews. The firm wanted to

expand a mine in Ontario, but a nearby indigenous group withheld its consent.

The

limits of De Beers’s power have been revealed in the past two years. Demand

slumped in China in late 2014, prompting retailers to buy fewer polished

diamonds. Companies that cut and polish stones became weighed down by excess

inventory. But the tools De Beers once used to use to prop up prices were no

longer at hand. There are legal restrictions on the share of excess diamonds it

may buy. Because it controls just one-third of the market, any production cuts

have limited effect on total supply. In fact, the firm may even have made

matters worse. Contracts with its customers sometimes encourage them to over

purchase—if they turn down too many of the stones De Beers offers them, they

risk being allocated a smaller share in future.

There

are signs of recovery. Bain, a consultancy, estimates that rough-diamond sales

rose by 20% in 2016. De Beers is becoming more flexible, easing rules for

buyers of its stones. More frequent reporting of its sales should help

investors understand the business. It also signals to competitors—without

engaging in collusion—when the market is deteriorating, enabling them to adjust

accordingly. “The value of transparency will come to exceed the value of

secrecy,” argues Fraser Jamieson of J.P. Morgan, a bank. Even so, excess inventory

may yet drag down the market.

Some

jewelers have recently reported slack sales. Mr Cleaver, an Anglo American

veteran, became the boss of De Beers in July. “The fundamentals of the industry

remain very good,” he says. In the coming years, he thinks, De Beers will

benefit from rising incomes, particularly in China and India. Its own research

shows that diamonds still capture the imagination: 26% of young American brides

say they dreamed about their future engagement rings years before beginning a

relationship.

But a

long-term risk looms over the industry: one day young couples may no longer

want diamonds at all. They are a “Veblen good”, as items that gain their value

solely from their ability to signal status are named, after Thorstein Veblen,

an economist who wrote about the spending of the rich. For Veblen goods, the

normal law of supply and demand does not hold: higher prices support demand,

rather than suppressing it. If a big gap opens up between the number of

diamonds offered for sale and the number of people willing to buy them at high

prices, diamonds could suffer a big, sustained fall in value and the entire

business could cease to make sense.

Today’s

20- and 30-somethings grew up as De Beers lost its monopoly and, wary of

helping competitors, cut spending on the advertising that had done so much to

create demand for diamonds in the first place. In recent years the company’s

marketing budget accounted for roughly 1% of sales, down from about 5% in the

1990s, according to Morgan Stanley. At the same time the notion of “conflict

diamonds” percolated through the popular consciousness—a movie called “Blood

Diamond”, starring Leonardo DiCaprio with a Zimbabwean accent, was released in

2006. Young couples, who earn less than their parents did at their age, may

prefer to spend their money elsewhere.

Complicating

matters, those who do want a diamond now have an alternative. Synthetic

diamonds have been available for decades, but only recently has the process

become cheaper and the result more refined. In 2015 a company called New

Diamond Technology made a ten-carat polished diamond of excellent quality, an

unprecedented feat. Sales of synthetic diamonds are thought to amount to just

1% of the rough-diamond market. But synthetic-diamond sellers are appealing to

young shoppers’ concerns for social and environmental causes—Diamond Foundry,

backed by Mr DiCaprio, boasts that its products are “as rock-solid as your

values”.

So De

Beers is trying to boost the allure of natural gems. “Long-term demand is only

going to be there if we continue to generate it,” says Mr Cleaver. That means

studying consumers; few other firms obsess over both mining-truck depreciation

and romance among young Chinese.

It also

means new advertisements. Some center on De Beers’s Forevermark brand, a tiny

code etched in a diamond that explains the gem’s provenance. Other spending is

for the industry as a whole. In 2015 De Beers and other miners formed a group

to pool money for generic diamond advertisements. Its first campaign ran in

America before Christmas, with the slogan “Real is rare”. YouTube videos show

Nick Cannon, best known as the ex-husband of Mariah Carey, a singer,

interviewing couples about their engagements. It is unclear if this will

persuade young romantics to spend thousands on diamonds.

If

synthetics grow in popularity, De Beers may need to become more aggressive.

Already, it is suing a synthetic-diamond company in Singapore for infringing

its intellectual property. Its own synthetic-diamond operation, for industrial

uses, holds more than 450 patents.

As the

company works to shore up demand, there is a source of solace. For over a

century it has fretted that big new finds would lead to plunging prices. “Our

only risk,” Rhodes declared, “is the sudden discovery of new mines, which human

nature will work recklessly to the detriment of us all.” But it seems that

threat is waning.

Get that

ice or else no dice. In total, explorers have sampled fewer than 7,000

kimberlite pipes. Of these just 15% have held diamonds and just 1% (about 60)

have held enough of them to justify building a mine. De Beers continues to

explore in Canada, South Africa, Botswana and Namibia—the only thing worse than

finding a big new source would be someone else finding it first.

Some

fancy technology is supposed to help. A “Superconducting Quantum Interference

Device”, for example, searches for changes in magnetic fields below Earth’s

surface, which might indicate the presence of kimberlite.But De

Beers regards any big discoveries, by itself or anyone else, as unlikely. “The

best and easiest deposits are already found,” says Norman Monteau the Lab Director for AIG The Jewelry Appraisers in Los Angeles The

company’s Canadian exploits are a reminder of just how arduous new mines can

be.

Mountain

Province, a firm that now works with De Beers, discovered Gahcho Kué’s first

pipe in 1995. The intervening years brought a separate, failed mine for De

Beers in Canada, lengthy negotiations with local officials and, at last, the

construction of Gahcho Kué itself.

That

required draining part of a lake. To bring in building supplies, the company

had to build the winter road. Staff would plough snow off a pond, drill through

thin ice, then pump up water to make the ice thicker, laying down a few inches

at a time. This was repeated over 120km, at temperatures often plunging to

-40°C, until the ice was thick enough to support a 500-tonne mining shovel,

broken into dozens of pieces. In

total, building Gahcho Kué cost $1bn. That was deemed worthwhile, compared with

the costs of finding and opening a mine elsewhere.

Other

companies have a few mines planned. De Beers is now focused on expanding

existing mines, not building new ones. New technologies may help liberate more

diamonds from kimberlite more efficiently. Even so, Bain estimates, production

will peak in 2019. Supplies of new diamonds will then start to fall, sinking by

1-2% each year until 2030.

For now,

aircraft shuttle staff to Gahcho Kué, dropping off miners to work for two-week

stretches. Nearly half the staff are locals, and a fair share are indigenous.

“We want jobs, just like everybody else,” says Eddie Erasmus, grand chief of

the Tlicho people. Among the mine’s maze of trailers are features typical of

any big-company workplace. There is a gym. Signs in the cafeteria remind staff

to eat fruits and vegetables, though many prefer heartier fare.Rob Coolen, who

oversees the ice road, began work at Gahcho Kué before the mine was built,

sleeping in a tent on the tundra. Coffee and bacon, he says, are essential.

The

cafeteria sometimes shudders with the reverberations of a blast from the pit.

Outside, work goes on day and night. Staff pile kimberlite onto huge trucks,

then haul the rocks to the processing plant. There, the ore passes through

breakers, crushers and scrubbers until pebbles are sent through a series of

X-rays and lasers, jets of air separating diamonds from worthless stones.

No

workers at Gahcho Kué touch the diamonds with bare hands. Only a few see the

gems before they are sent off by plane to be valued. In September Mr Coolen

stood atop a steel grate in the processing plant, the platform shaking as giant

scrubbers churned beneath. “Occasionally you see one,” he shouted above the

din, “and it’s just gorgeous.” The mine is expected to reach full production in

March. By 2030, its diamonds extracted, it will close.

This

article appeared in the International section of the print edition.

Sunday, February 19, 2017

Valentine's Day Surprise

Was She Expecting a New Diamond for Valentine's Day?

Lets Find Out aiglabs.com The Jewelry Appraisers

So, Was she expecting a new diamond for Valentine's Day?

Wow......you really surprised her.

Now make an appointment to have that ring appraised

with one of our aiglabs.com Jewelry Appraisers.

Subscribe to:

Posts (Atom)